Billing software is a crucial tool for businesses to streamline their invoicing, payment processing, and financial management processes. Here are some of the key features that you should look for in a billing software:

Invoice Creation:

The software should allow you to create professional invoices with customisable templates and branding.

Payment Processing:

Integration with various payment gateways to accept payments online, including credit cards, debit cards, and digital wallets.

Recurring Billing:

Automated billing for recurring services, such as subscriptions or monthly rentals.

Customer Management:

Maintain a database of customer information, including contact details, payment history, and billing preferences.

Tax Calculation:

Automatic calculation of taxes based on customer location and applicable tax rates.

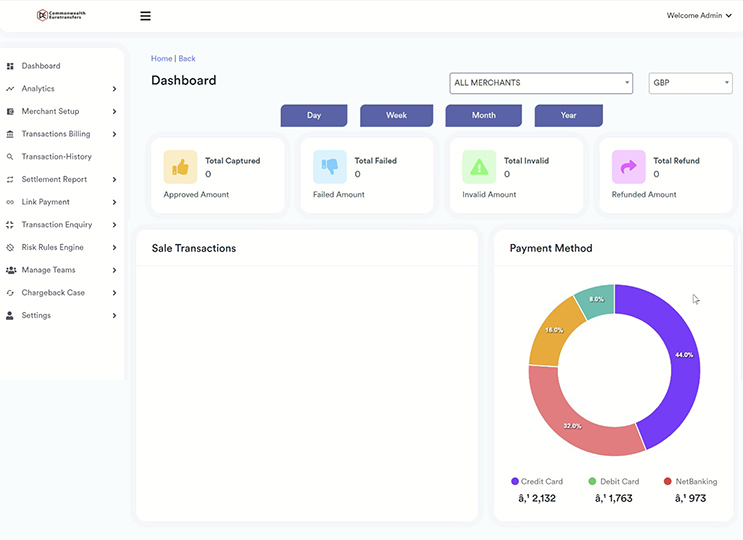

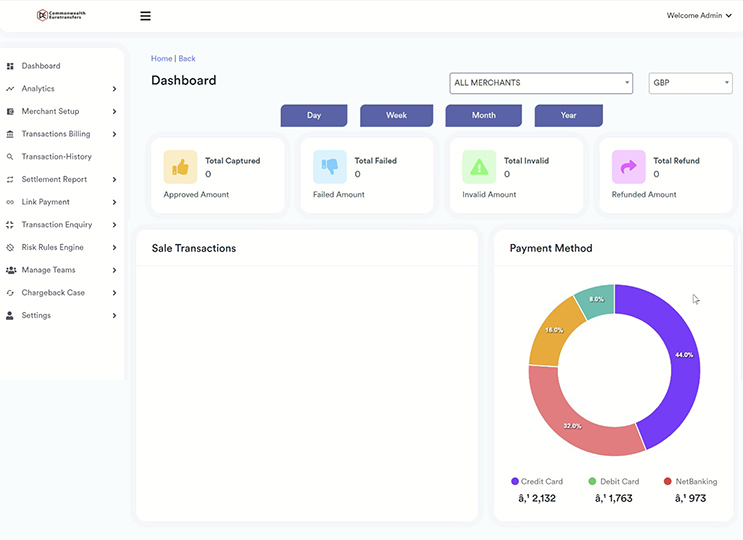

Report Generation:

Generate detailed reports on sales, revenue, and other financial metrics to track business performance.

Advanced Features:

- Project Management Integration: Integration with project management tools to track time spent on projects and generate invoices based on time and materials.

- Inventory Management: Track inventory levels and generate invoices based on product sales.

- Expense Tracking: Manage and track business expenses to improve financial visibility.

- Accounting Integration: Integration with accounting software to streamline financial processes and reduce manual data entry.

- Multi-Currency Support: Support for multiple currencies to cater to international clients.

- Customisable Workflows: Create custom workflows to automate repetitive tasks and improve efficiency.

- Mobile Accessibility: Access your billing software from anywhere using a mobile device.

Get In Touch